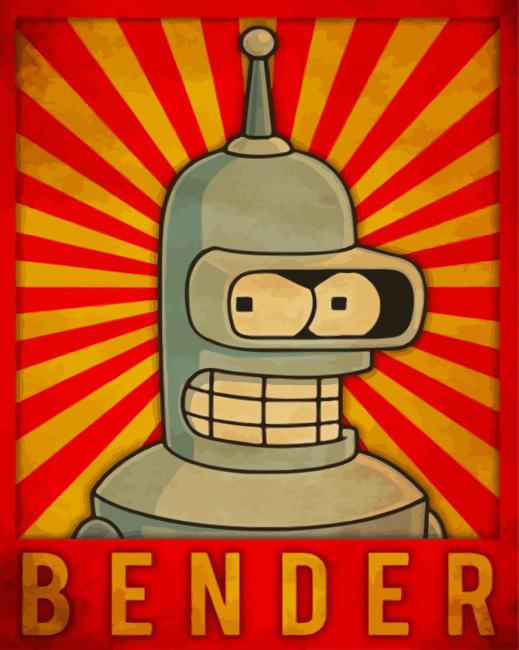

Take care of your fucking teeth.

Take care of your fucking teeth.

And once more, for the folks who don’t get it…

Take care of your fucking teeth.

This, but also your knees.

Any body part with a double E really.

Weener

The real value is in the comments

Clean the pipes at least once every 48 hours is what my doctor told me.

Spleen

These 2 comments hit me straight to the core. My teeth and my knees are my primary problems right now.

My wife stopped drinking (occasional glasses of wine) and these two problems went away for her.

deleted by creator

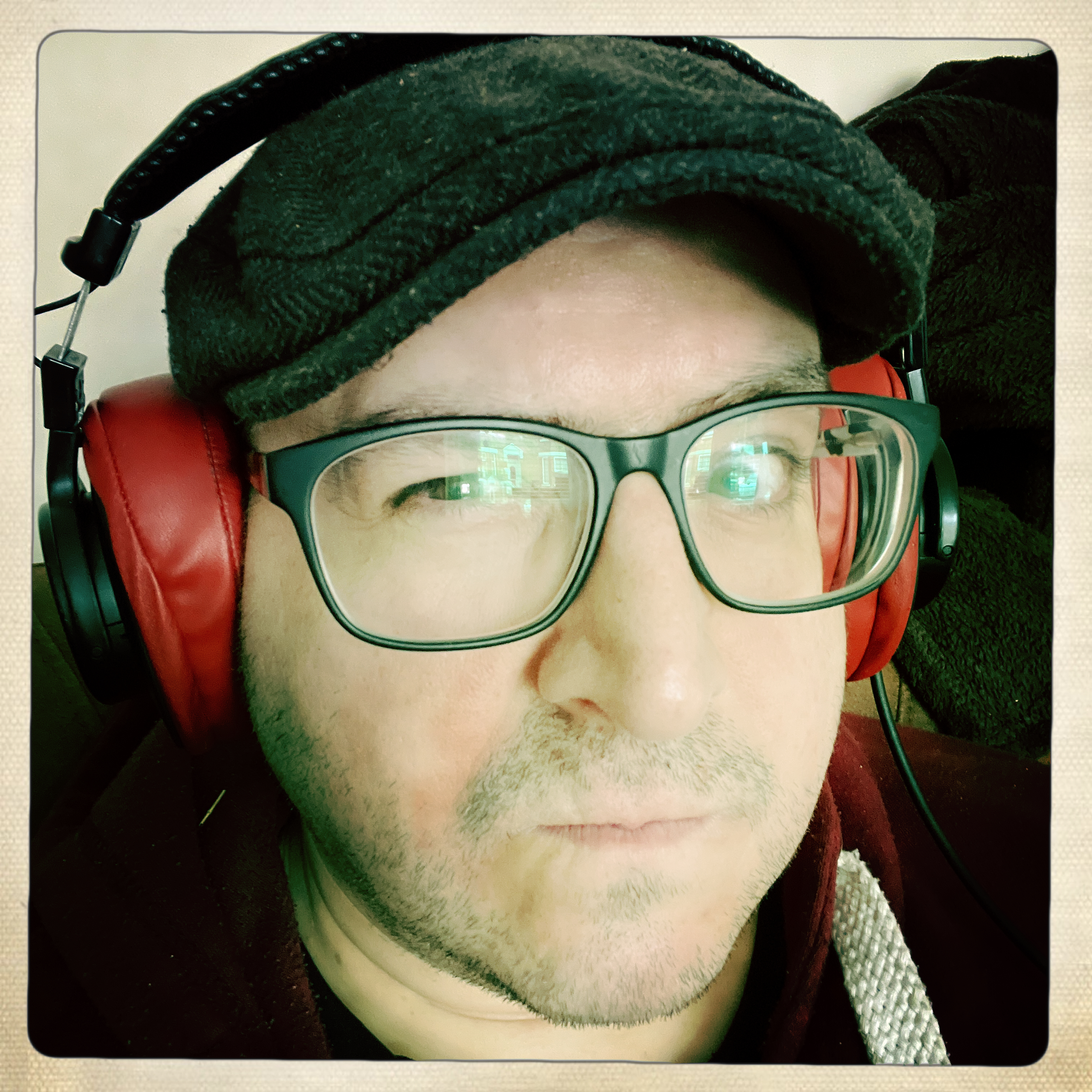

In addition, take care of your fucking joints and your hearing. They will never get better, you can only slow the degradation.

My joints have always been terrible, I have much to look forward to I am sure

Start saving for retirement now. You can make literally millions by putting away 10% of your income early on. Do it automatically so you never even notice the money gone.

If you are worried about making the wrong choice and your company doesn’t have a 401k, open an IRA somewhere (Fidelity if you need someone to make the decision for you) and pick a date targeted fund. Set up auto deposit. Never look at the balance.

You can always make it better later but for now the best thing to do is start. Don’t let analysis paralysis get in the way.

If 20 year old me put away 10% of her income, it would just mean borrowing more. Current me would just have more debt and be worse off than now.

Yeah a lot of people in there twenties can’t even spare 5%. I’m thirty and I can’t.

“Save money for retirement” Yeah so I can pick up painting? The only thing I’ll be able to paint is the ceiling if I want to retire.

Have you seen the price of emulsion?

Oh I was going to use the free stuff and use a 12 gauge brush

Some companies in the US have a deal to where they match on 401k. One such organization puts in 5% for your 2%. Two percent is low enough it wouldn’t be a hit to almost any cash in your pocket given that the money is taken out pre tax.

I don’t want to come off as insensitive, so I’ll try to phrase things carefully.

If you have even the slightest spare money per pay period, like $30, and a 401k or 403b is offered to you, you really need to do it.

That money comes out of your check before taxes, so you will be investing more money than what actually comes out of your check. By deduction 6% of a $15/hr full time job, you’re putting in $36, but your paycheck will only go down about $30-free money!

Many places will match you some, say half of that first 6%, so now you’re saving $54 while only being out $30. You’ve almost doubled your money in one week!

Come tax time, you’ve saved $1872, and you’ve been given a free $936. It doesn’t stop there though, because now you only are paying income tax on $29,328 instead of $31,200. If you get a tax rebate now, you will get even more back!

So now you’re saving $2808 a year at age 20. Let’s put that in one mutual fund, a SP500 index fund. Over the last 10 years, that has returned 12‰, but let’s be conservative and call it 10. If you never make a cent more per hour, by age 65, you will have saved $84,000 and your job has chipped in $42,000, over a year’s pay! But with that 10% compound interest, you have $2,000,000! You are a multi-millionaire for $30/wk!

If you get a raise or get a better job in the future, this number can be even higher.

Please keep this in mind. Even if you can’t do it now, do it ASAP. Here are the same numbers, but starting at 30 instead of 20.

Still amazing, but seeing this difference is why we older on ones tell you not saving earlier was our big regret.

I hope this was helpful and doesn’t get taken as a “pick yourself up by your bootstraps” thing.

Yes that’s cool and all but I have to pay rent and food and as things stand now the average salary is like enough to cover ⅓ of the rent

You entirely missed the point he was trying to make.

No, I understand what he’s trying to say. The point is: doing what he recommends requires having money to save up in the first place, and for a big portion of people in their 20s that’s not the case.

It’s valid, and it sucks. If you can even do $5, it’s worth it. But the world is absolutely against you right now. A lot of older folk don’t quite get how bad it’s gotten.

However, saving a dollar today is worth more than saving two dollars ten years from now. And having an emergency fund might actually save your life.

Hopefully something happens to shake up housing. These prices are absolutely criminal.

Question: If I had money saved in a 401k or Roth IRA, what if I died before I retired? What would happen to the money? Would it go back to the government or to a close relative?

You can (and should) assign a beneficiary for the account. They receive the money if you die.

You declare your beneficiaries when signing up - it goes to them, I believe.

It’s easy to believe you’re invincible in your twenties. Or “later me can deal with it.”. As that later version of me, I’m not a huge fan of that earlier version in a lot of ways. It’s fine, I’m who I am for what I went through, and I’m righting the ship. But the more cans you kick down the road, the more you have to deal with later and the harder they are to deal with. Physically, mentally, financially. It’s ok to try to live life freely, but definitely be aware of this and consider kicking one less can every chance you get.

So much this… Despite trying to drive defensively I have been involved in two major car accidents. The first one I walked away from, but the second one put me on Flight for Life. Despite the accident itself being pretty bad, the only physical issue was a broken leg that took a couple years to heal properly. However the REAL issue took longer to realize – something from that accident has caused me to have continued sleep issues since then. I’ll be on medications the rest of my life probably, and even then I still have trouble getting restful sleep if I’ve been physically active.

Yeah it’s easy to feel invincible when you’re young, and your body can heal from a lot, but just remember that those things can also fuck up your shit in ways you might not realize until years later. Things you take for granted now (like sleep) can really screw up your enjoyment of life when they don’t work right.

It’s ok to try to live life freely, but definitely be aware of this and consider kicking one less can every chance you get.

Got it.

If you’re working in the attic, under the house, around dirt/dust/debris wear a mask/respirator. It’s so nice to be able to take deep breaths without coughing later in life (and outclass your peers in the stamina department) 👍

Pro tip: Even though they’re bigger and bulkier respirators are much more comfy than masks.

Wear hearing protection. Tinnitus blows.

I took the aftermarket stereo out of my car in my mid 20s so I can hear bass well still but I often read people’s lips because that mid range hearing is not close to how it used to be if there are any ambient noises at all.

it really does suck. mine started since I was 14, like wtf

rrreeeeeeeeeeeee.

Thanks all those concerts I went to in my 20s.

The random aches and pains you start waking up with are here to stay. Learn to embrace them.

And drink more water.

Hey you, reading this right now. You just drank water didn’t you?

Does whisky, ginger beer and lime cordial count?

Well most whiskey is 80 proof, so 60% water! Counts

There’s definitely some water in those!

Exactly! 😃

And get your eyes checked once in a while. For a while I would get massive headaches by early afternoon. I thought I had a nutrient deficiency. Bloodwork came out ok. Turns out I needed stronger glasses.

- Get an exercise routine now and keep it

- Take care of your teeth

- Invest in your retirement now

- Keep your mind sharp

- Eat right most of the time

Spend quality time with your parents (assuming you’re on good terms of course).

I lost my dad when I was 30, after a short and unexpected illness, and I regret not spending much more time with him when I could have.

This hit me like a truck. I lost my father at the beginning of the month due to some tragedy that occurred.

We weren’t on speaking terms (a decision I made), but I’d always planned to one day see if I could turn things around, which will never happen now. Never in a million years would I ever have expected it to come down to this.

Aw mate… I’m so so sorry 😔

That’s a really hard situation, and I hope you’re doing ok. Take care.

I’m 36.

Do yourself a favor. Dont drink alone.

Sound like a tall order? Work on that. Your liver is important. You’ll be alone a lot. You get in that habit now, it’ll be with you when you’re 40, and your liver will not be a fan.

“Work on that” what do you mean?!? – you get home from a shit day at work, or you stop at a bar on the way home. You get drunk to numb the calcified agony of the working life. – that’s what I mean. There are other ways to numb thatee less maladaptive, they just take more effort and take affect less quickly. Move toward it for me tak health.

Do you spend hours on the couch scrolling on your phone? Try to go on a 2 mile walk every day. 4 is even better. Your heart will thank you. Your hips, knees and ankles will thank you. Listen to a podcast. You can still binge content, just… Get your body moving. And get your eyes to focus on the horizon every now and then. It’s good for your eyesight long term.

Get yourself out of breath, heart racing from pushing yourself physically at least once a week. Preferably nearly every day.

Take up an artistic hobby. Write bad poems. Write bad stories. Write bad songs. Draw dumb cartoons. Draw bad portraits. Sing your best, but sing. Dance.

Stretch.

Brush your teeth twice a day.

Floss.

Do planks.

Side planks too.

Drink water.

You should be able to do 20 pushups.

You should be able to touch your toes.

Sprint as far as you can at least once a month.

Just don’t get complacent being complacent.

Invest $1 for every $1 you put in a savings account. Put $1 into a retirement fund for every $1 you put in that savings acct too. Oh, and $1 in a Roth IRA at the same rate.

Got an extra $100? $25 to savings $25 to investing, $25 to Roth, $25 to 401k.

Do that til your savings ~= 6 months living expenses. Then stop that fund and split it 3 ways for investing, retirement, retirement.

Use your investment (and if things go south, savings) for a down payment on a house to minimize your mortgage.

Edit: in debt? Have more than 1 source of debt? Focus on the biggest one. If you can make minimum payments on all and have money leftover it goes to the largest debt/worst interest. Pay em off one at a time til your chins above water.

Yeah regarding the drinking alone; it’s an easy escape from whatever is happening right now (45+ yrs here). Not an alcoholic but I definitely have a bad habit (that’s what all alcoholics say, right?) during non work hours to disconnect (not sure from what to be honest…life?)

I’m not good by what I suggest lol.

Trying to get them young because these habits die hard.

It is easy to say you’re not an alcoholic. Have you read what defines alcoholism? I qualify. I wouldn’t assume I do.

Here’s the cold slap in the face for us all. Count up your points…

Alcohol is often taken in larger amounts or over a > longer period than was intended.

There is a persistent desire or unsuccessful efforts to cut down or control alcohol use.

A great deal of time is spent in activities necessary to obtain alcohol, use alcohol, or recover from its effects.

Craving, or a strong desire or urge to use alcohol.

Recurrent alcohol use resulting in a failure to fulfill major role obligations at work, school, or home.

Continued alcohol use despite having persistent or recurrent social or interpersonal problems caused or exacerbated by the effects of alcohol.

Important social, occupational, or recreational activities are given up or reduced because of alcohol use.

Recurrent alcohol use in situations in which it is physically hazardous.

Alcohol use is continued despite knowledge of having a persistent or recurrent physical or psychological problem that is likely to have been caused or exacerbated by alcohol.

Tolerance, as defined by either of the following:

*A need for markedly increased amounts of alcohol to achieve intoxication or desired effect.

*A markedly diminished effect with continued use of the same amount of alcohol.

Withdrawal, as manifested by either of the following:

*The characteristic withdrawal syndrome for alcohol (See the “How is alcohol withdrawal managed?” section for some DSM-5 symptoms of withdrawal).

*Alcohol (or a closely related substance, such as a benzodiazepine) is taken to relieve or avoid withdrawal symptoms.

The DSM-5 defines AUD as a problematic pattern of alcohol use leading to clinically significant impairment or distress, as manifested by at least

booze shame warning

2 of those previous 11 symptoms occurring within a 12-month period.

The number of symptoms determines the severity:

2 to 3 symptoms for mild AUD,

4 to 5 for moderate, and

6 or more for severe.

Happy Friday I am sorry

Whew! I drink 4 or 5 beers daily and have for years. None of those listed markers applies to me. I don’t drink to get drunk, just to relax.

Four or five a day and not getting drunk? Holy shit, that’s a tolerance! If this isn’t tongue-in-cheek, I say examine the list a little more closely.

That’s typically less than a beer per hour. I get a buzz if they’re IPAs or other high APV beers, but otherwise I just like the mellowing effects

Okay, you do you, but my father’s career was as an AODA counselor, so I’ve heard a lot of stories, and “I just use it to relax” comes out of the mouths of alcoholics so often it’s a cliché. There are other ways to relax without the long-term damage to one’s health.

This alone qualifies you as an alcoholic. You can kid yourself all you want. Your body will catch up with you.

A downvote doesn’t change this.

Both of the last two apply to you. As do the second and third.

You meet at least 4 of them. Your alcoholism is “moderate”. And that’s assuming you’re being honest with yourself about the rest.

That also relates a lot with other addictions (including behavioral addictions like social media or general electronic addiction)

Remember alcohol is itself a central nervous system depressant. I do drink in moderation (2-3 a week) but everyday is a bad idea, even outside of any harm to your liver or whatever, because it can make you depressed and downers of all sorts (including Benadryl) accumulate damage over time that can contribute heavily to dementia risk.

If you are worried about it, that seems a clear enough signal, you don’t have to label yourself as anything, cut down if you can. Going to the gym or yoga class after work can provide the same wind down in a healthier way. I do understand wanting a separation - it is so nice to come home, sit on the porch with a drink, to separate work from home life, but most days I go to yoga instead.

None is better than some, some is better than a lot.

Wear earplugs at loud concerts and parties and at work if you have a noisy job.

People will make fun about you, but believe me, permanent tinnitus really sucks.

Yeah I am in my 40s and I when its quiet I hear that squealing and I really cant hear what I used to.

Plus, if you preserve your hearing you’ll be able to hear all the high dog whistle frequencies that everybody else won’t be able to, and you’ll feel just a tiny bit superior for no good reason.

Smoking, drinking and gambling never ends well. Stay away from addictions.

Don’t try to proof how manly you are to your friends/girls. It rarely pays off. Its ok to have a veggie dish at the restaurant instead of a bloody steak. Its ok to not speed with your car to look cool. Its ok to wear whatever the fuck you want as long as you like it, it fits well and its practical for you. Do what you like and be proud of it.

Always save time for your hobbies. Growing up doesn’t means you can’t have fun. If you are in a relationship make sure your partner gives you enough space and time for yourself.

Travel. Try new things. Eat food you’ve never tried before.

Get into the habit of reading. Actual books, not just things like lemmy.

Realize that literally every person you meet is a walking story, just like yourself

Brush your fuckin teeth.

Also: Floss. Seriously. Take care of your damn teeth. They’re important.

Take care of your damn teeth. They’re important.

I’m 34 and I already lost half of my teeth. By 40 they’ll probably all be gone. It’s definitely genetics, but also very much the lazyness in my youth that caused this.

If someone in their twenties reads this: Brush your fucking teeth, seriously. I had a phase in my life where I was living with constant pain for almost a year and almost went insane. Nobody should have to live like this.

Also don’t brush your gums too hard, I did that a bit when I didn’t know better, and my gums receded slightly. Turns out those things don’t come back. Make sure you brush that area though!

My electric toothbrush was an amazing investment. It flashes red lights if I press too hard while brushing. You’d think after 10 years of this thing that I’d develop an intuition about how hard to press, but it still yells at me to back off all the time. It’s made a huge difference for the health of my teeth.

Don’t eat between meals to re-establish your saliva microbiome and pH. This will do a lot for prevention of carie growth.

Working hard is for suckers.

Getting paid is what the whole song and dance is about.

I’m 43 and gradually coming around to the fact that as long as my managers aren’t actively talking to me about not doing enough, then I’m doing ok. It’s worked wonders for me being anxious that I’m not doing what’s expected of me.

It’s fine to do the bare minimum as long as you’re not fucking things up for your colleagues. You get paid to cover the minimum of your job description, not to work yourself to death.

We should have been taught this at 23 not FAFO 20 years to learn it.

Sucks to suck being a pleb I guess… “real” people made careers in the mean time.,

Isn’t it just.

I’m surrounded by young lads who think that working themselves to the bone is some kind of flex, or lazy pricks who give the others shit for not working hard enough.

These days I just crack on and do my thing. My manager is happy with my work, and I can sometimes spend a good five hours just scrolling the internet, looking busy.

lazy pricks who give the others shit for not working hard enough.

Upper management potential spotted lol some people are born to win in this system…

Yeah, at some point, they can do but so much bullshit. If you do your job, adults aint got time to bullshit. People got kids lol.

Fuck I needed this. I am at the point where I am about to talk to a psychiatrist about this because I have such bad anxiety about whether I’m doing okay or not at work.

Moisturize, use sunscreen. Protect your skin and you’ll look young even in old age.

Sunscreen sounds unmanly, but think about how you’ll feel with half your nose excised. Put it on your face especially!

And your neck. Golly, that sucker does weird things later in life. Or is it moreso for women?

Mine is modest; but practice being mindful of your emotional reactions.

If something upsets you, interrogate why, and whether your reaction will help. 90% of the time it won’t, so learn to appreciate that you are upset, but don’t let it control you. Because if you don’t you’re going to start seeing the world through incredibly negative eyes.

For example, I used to be a nightmare behind the wheel, always getting angry with shitty drivers and red lights. But I began trying to catch those thoughts, and asked myself whether they would stop other drivers being shitty, or whether it would stop me getting caught at red lights. Would I still be angry in ten minutes? The answer is almost always no, so to expend that energy feels like a waste of time to me now.

Sure, I still get pissy, but I don’t sit with it for longer than I need to. You wouldn’t sit in acid, so why sit in anger?